Start paying your tuition back when you get a job.

With the Stride Funding & Tech Elevator Income Share Agreement (ISA), start paying your tuition when you’re hired and earning at least $40,000 per year.

The ISA tuition plan is currently only available for Tech Elevator's Full-Time Program. ISA plans are not available for residents of: Alabama, California, Colorado, Iowa, Illinois, Maine, Maryland, New York, South Carolina, Washington D.C. or Washington. Read more information on Stride Funding's Privacy Policy

Our Income Share Agreement

Focus on Class, Not Cost

With an ISA, you pay a deposit of $2,000 and then you pay $0 for your career training until after you’ve got a job making $40,000 per year! There are no income or credit score requirements, so regardless of your current financial situation, you’re eligible to attend Tech Elevator's Full-Time program under the ISA tuition plan.

Manageable Payments

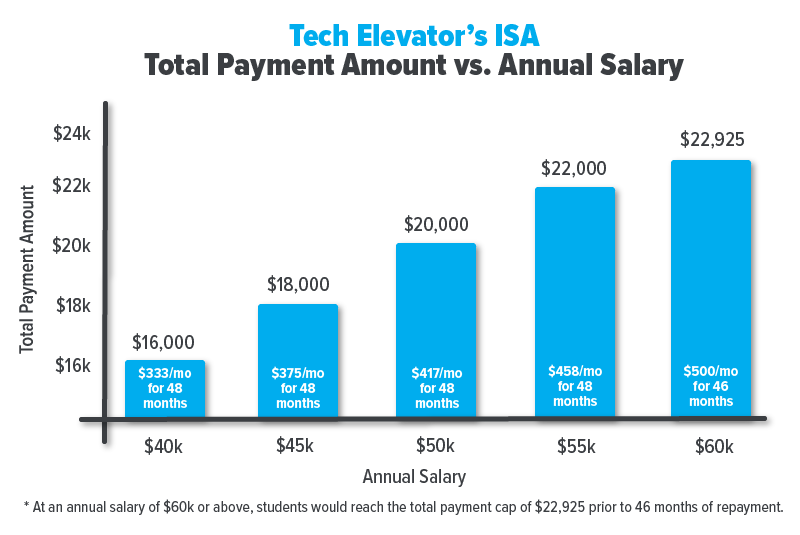

After you’ve reached the minimum income threshold ($40,000 per year), you’ll start paying back 10% percent of your monthly earned income for 48 months. Monthly payments stop early if your total payments ever reach 1.5x funded tuition.

Bank on Yourself

Our support team + your career ambition = great success. Have confidence in your ability to graduate and break into a new in-demand field.

Grace Period

No payments for 3 months after graduation. Focus on getting a great job, not making payments

14 Week Program

Paid When Your Get A Job

Before You Receive A Job

Deposit

$ 2,000

After You Receive A Job

For At Least $40,000 A Year

Percent of Salary

10%

Maximum Monthly Payments

48

Maximum You Pay

$22,925

The ISA tuition plan is currently only available for Tech Elevator's Full-Time Program. ISA plans are not available for residents of: Alabama, California, Colorado, Iowa, Illinois, Maine, Maryland, New York, South Carolina, Washington D.C. or Washington.

Read more information on Stride Funding's Privacy Policy

See your payments once you land your job.

Use our helpful calculator tool to understand your payments.

Tech Elevator Versus Other Bootcamps

Compare programs and you'll see Tech Elevator has the lowest maximum payback for ISAs.

Lambda School

17%

Monthly Income Share

24

Maximum Monthly Payments

$30,000

Maximum Payback

App Academy

15%

Monthly Income Share

36

Maximum Monthly Payments

$31,000

Maximum Payback

Tech Elevator

10%

Monthly Income Share

48

Maximum Monthly Payments

$22,925*

Maximum Payback

* Includes $2,000 deposit

Thinkful

15%

Monthly Income Share

36

Maximum Monthly Payments

$27,000

Maximum Payback

Coding Dojo

9.8%

Monthly Income Share

60

Maximum Monthly Payments

$29,995

Maximum Payback

*Data as of June 2022

Who is the ISA right for?

The ISA joins existing funding sources like loans through our lending partners Sallie Mae and Ascent, workforce grant dollars and scholarships. Everyone’s situation is different so each person will have to decide what is right for them but, it’s important to us to provide a variety of options to pay for our program.

We suggest that you compare all options to decide which option is the best fit for you. Check out our article on how to pay for a coding bootcamp as you research your options.

Why did we launch the ISA?

At Tech Elevator, we’ve always put our students first and we have been watching closely and cautiously as the ISA funding model has become more prevalent.

We are adding an ISA option now because we are able to offer them directly to students with some of the most student-friendly terms in the industry. For us, doing right by our students and getting ISAs right has been worth the wait. Read more about why we launched an ISA.

More Accessibility

Accessibility to skills-based learning is more important than ever. ISAs give potential students more options to finance their education.

Financial Flexibility

Students can take steps toward their future with student-friendly, flexible tuition assistance options.

More Inclusivity

By providing more payment options, students from an even wider variety of backgrounds can access our program.